- History of trading

Why did the dot-com bubble burst?

Do you want to know how to make money from this?

Register for free and get expert advice, access to a training course and webinars.

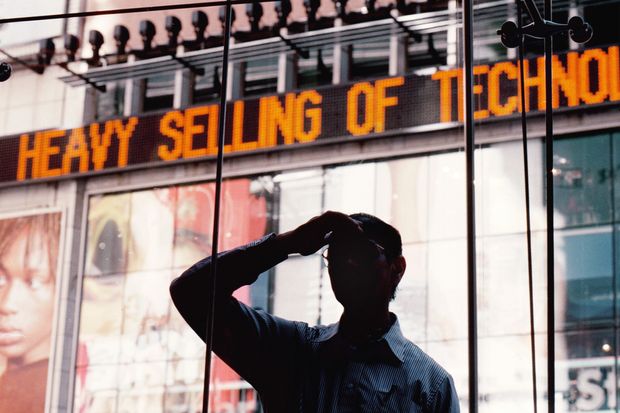

The peak of the so-called “dot-com bubble” was characterized by an unprecedented frenzy around internet companies. Unbridled speculation and excessive investor optimism led to the significant overvaluation of tech startups, which eventually resulted in a sharp market crash.

A large-scale media campaign by leading financial publications, such as The Wall Street Journal, Forbes, and Bloomberg, played a key role in inflating this bubble. By publishing optimistic forecasts about the future earnings of internet companies and promoting the idea of quick wealth, the media fueled investment excitement and contributed to rising stock prices.

In this article, we delve into the dot-com bubble in detail as part of our series on “black swans” in financial markets.

What is the dot-com bubble?

The period from the mid-1990s to the early 2000s saw an unprecedented surge of interest in internet companies, typically with “.com” in their domain names. This phenomenon, known as the “dot-com bubble,” was marked by a massive influx of investment into tech startups, many of which lacked a stable business model. Several factors contributed to this, including the rapid growth of the internet, low interest rates, and optimistic analyst forecasts.

Investors, both large institutional players and retail investors, actively bought shares in tech companies in hopes of quick profits. As a result, the market capitalization of the internet sector soared, and the Nasdaq index reached record highs. However, as is often the case in such situations, excessive optimism and speculation led to the formation of a bubble, which eventually burst.

The collapse of the dot-com bubble was triggered by a combination of factors, including the exhaustion of funding sources, investor disappointment in the viability of many internet projects, and a general economic downturn. The Nasdaq crash became one of the most significant stock market collapses in history. Many tech companies went bankrupt, while the survivors incurred heavy losses.

The consequences of the dot-com crisis were felt not only by the tech sector but also by the global economy. It served as a lesson for investors, highlighting the importance of thoroughly analyzing companies before investing. Additionally, the dot-com crash led to a reassessment of regulatory policies for financial markets.

Why did the dot-com bubble form?

The democratization of internet access through web browsers in the early 1990s, along with the rapid spread of personal computers, created favorable conditions for the explosive growth of the internet industry. This new technological landscape became a magnet for entrepreneurs eager to carve out their niche in the fast-growing online services and e-commerce markets.

At the same time, lower interest rates in the late 1990s made high-risk investments in stocks, including those of innovative internet companies, more attractive. Retail investors, professional traders, and venture capitalists, enticed by the prospects of the digital economy, eagerly poured money into young tech startups. Capital gains tax cuts, legislated in 1997, further fueled speculative activity in the stock market.

Investment banks, eager to capitalize on the growing demand for IPOs, aggressively promoted the shares of new tech companies. Investors, driven by excitement and fear of missing out on potentially massive profits, ignored traditional financial metrics and invested in companies that often had not yet turned a profit. As a result, a speculative bubble formed, filled with the hot air of unrealistic expectations, ready to burst at the slightest negative trigger.

How did the dot-com bubble burst?

The rise and subsequent fall of the dot-com bubble are closely tied to the dynamics of the NASDAQ Composite index. Between January 1995 and March 2000, the index showed impressive growth, increasing more than fivefold. However, the subsequent 75% drop over the next two and a half years wiped out nearly all the previous gains.

One of the most striking consequences of the bubble’s collapse was the mass bankruptcy of internet companies. High-profile players like Pets.com and Boo.com could not survive the competition and were forced to shut down. However, some companies, like Microsoft, Amazon, and eBay, managed to adapt to the new market realities and eventually became industry leaders.

The key cause of the formation and subsequent bursting of the dot-com bubble was excessive speculation in the stock market for internet companies. Investors, caught up in the euphoria of the new economy’s potential, were willing to pay far more for stocks than their actual value. As a result, many internet companies’ stock prices far exceeded their fundamental valuations, creating the conditions for a sharp market crash.

When the bubble burst, it caused panic among investors, leading to a mass sell-off of dot-com stocks. Consequently, the market capitalization of the tech sector shrank by trillions of dollars, and many investors suffered significant financial losses.

Which companies survived the dot-com crash?

By the end of 2001, most dot-com stocks had gone bankrupt. Even blue-chip tech companies like Cisco, Intel, and Oracle saw their stock prices drop more than 80%. It took Nasdaq 15 years to recover to its peak, which it finally did on April 24, 2015.

Many companies were less fortunate than those mentioned above. Here are a few former internet players that met their demise when the tech bubble burst or shortly after: Boo.com, Global Crossing, Northpoint Communications, Pets.com, Webvan, and Worldcom.

Why did the crash happen?

Pinpointing the exact cause of any financial bubble’s burst is difficult, as it involves many interconnected factors. However, in the case of the internet bubble, two key events undoubtedly played a significant role in its rapid deflation after the NASDAQ index peaked in March 2000.

The first factor that accelerated the bubble’s collapse was the Federal Reserve’s interest rate hikes. In an attempt to curb inflation and prevent economic overheating, the regulator raised the federal funds rate several times in the late 1990s and early 2000s. The rising interest rates made high-yield, high-risk investments like internet stocks less attractive compared to more stable bonds.

The second important factor was the recession that began in Japan in March 2000. News of the downturn in Japan’s economy caused a wave of concerns among investors worldwide, triggering a mass sell-off of stocks and a shift of capital into safer assets.

The combination of these two factors led to a negative feedback loop. The falling stock prices of internet companies triggered panic among investors, which in turn led to further sell-offs. This process, known as capitulation, continued until the NASDAQ index hit bottom in October 2002.

How did the dot-com crash impact the economy?

The boom period of internet companies, or dot-coms, was accompanied by an unprecedented stock market frenzy. Young, rapidly growing companies in need of substantial financial resources attracted investments from venture lenders and private investors.

However, instead of carefully analyzing the financial health of these companies, many investors were guided solely by short-term indicators, such as website traffic growth. Fundamental business aspects, including profitability and long-term prospects, were often ignored.

As a result, dot-com stock prices far exceeded their real value, leading to the formation of a speculative bubble. The burst of this bubble caused widespread panic in the market and a sharp decline in the NASDAQ index.

The dot-com crash had serious consequences for the economy. Many companies went bankrupt, while others faced financial difficulties. Mass layoffs in the tech sector and reduced advertising investment negatively impacted related industries.

However, it’s worth noting that although the dot-com crash had significant consequences, it did not lead to a global economic catastrophe. The market gradually recovered, and many tech companies that survived the crisis later became industry leaders.

Is the AI bubble the new dot-com bubble?

Many are now comparing the boom of companies investing in generative artificial intelligence to the dot-com companies. However, comparing these two phenomena is not entirely accurate. The global economic situation after the terrorist attacks of September 11, 2001, significantly impacted the monetary and fiscal policies of developed countries. These events were a “one-time catastrophe” that necessitated sharp interest rate cuts and economic stimulus. In the absence of such shocks, the trajectory of economic development might have been smoother, and central bank interventions would have been less significant.

Additionally, when comparing the current economic situation with the period of the tech bubble, there are notable differences in fiscal policy. While the U.S. showed a budget surplus in the early 2000s, the idea of a balanced budget for developed countries today seems almost utopian. Increased government spending provides a certain “safety cushion” for the economy, reducing the risks associated with potential financial crises.

Can the market avoid another bubble?

Investing in innovative tech companies, especially in their early stages, carries a high level of uncertainty. To minimize risks and avoid repeating the mistakes that led to the dot-com crash, investors should adhere to several principles.

Careful analysis of fundamental factors is crucial when making investment decisions. Before investing, a thorough evaluation of a company’s business model, cash flow generation potential, and long-term growth prospects is necessary. Short-term speculation based solely on expected growth can lead to capital loss.

Avoiding investments based purely on expectations is another important principle. Companies that have not yet demonstrated their ability to generate profits and ensure sustainable growth carry a high level of risk. Investments in such companies are often driven by speculative expectations, which can lead to the formation of new bubbles.

The beta coefficient as a risk indicator also deserves investor attention. A high beta coefficient indicates increased stock volatility, meaning its price may fluctuate significantly depending on market changes. During economic downturns, high-beta stocks tend to fall more sharply than the market as a whole. Therefore, investments in companies with high beta coefficients are associated with increased risk.

Do you want to know

How to make money from the news

Register for free and get:

- Expert consultation;

- Access to the training course;

- Opportunity to participate in webinars