- History of trading

Why did the stock market crash of 1929 happen?

Do you want to know how to make money from this?

Register for free and get expert advice, access to a training course and webinars.

What made the American economy what it is today? Of course, we associate it today mainly with large corporations – both older ones, like Ford, and the flagships of advanced technologies, like Apple and Nvidia. But its current structure is due not only to prosperity, but also to falls.

In the first article, we have already analyzed in detail the phenomenon of “black swans” in the market. Now we will move on to specific cases of market falls in history that had the greatest impact on trading and the economy.

First of all, we will, of course, tell and answer popular questions about the US stock market crash of 1929, which provoked a chain reaction of negative economic phenomena that resulted in the infamous Great Depression. It was the deepest and longest economic crisis in US history, covering the period from 1929 to 1941.

The following years were marked by a series of economic shocks, including the banking crises of 1930 and 1931, as well as the imposition of the protective Smoot-Hawley tariffs, which led to a sharp reduction in international trade. These events significantly worsened the economic situation in the country and led to a long recession.

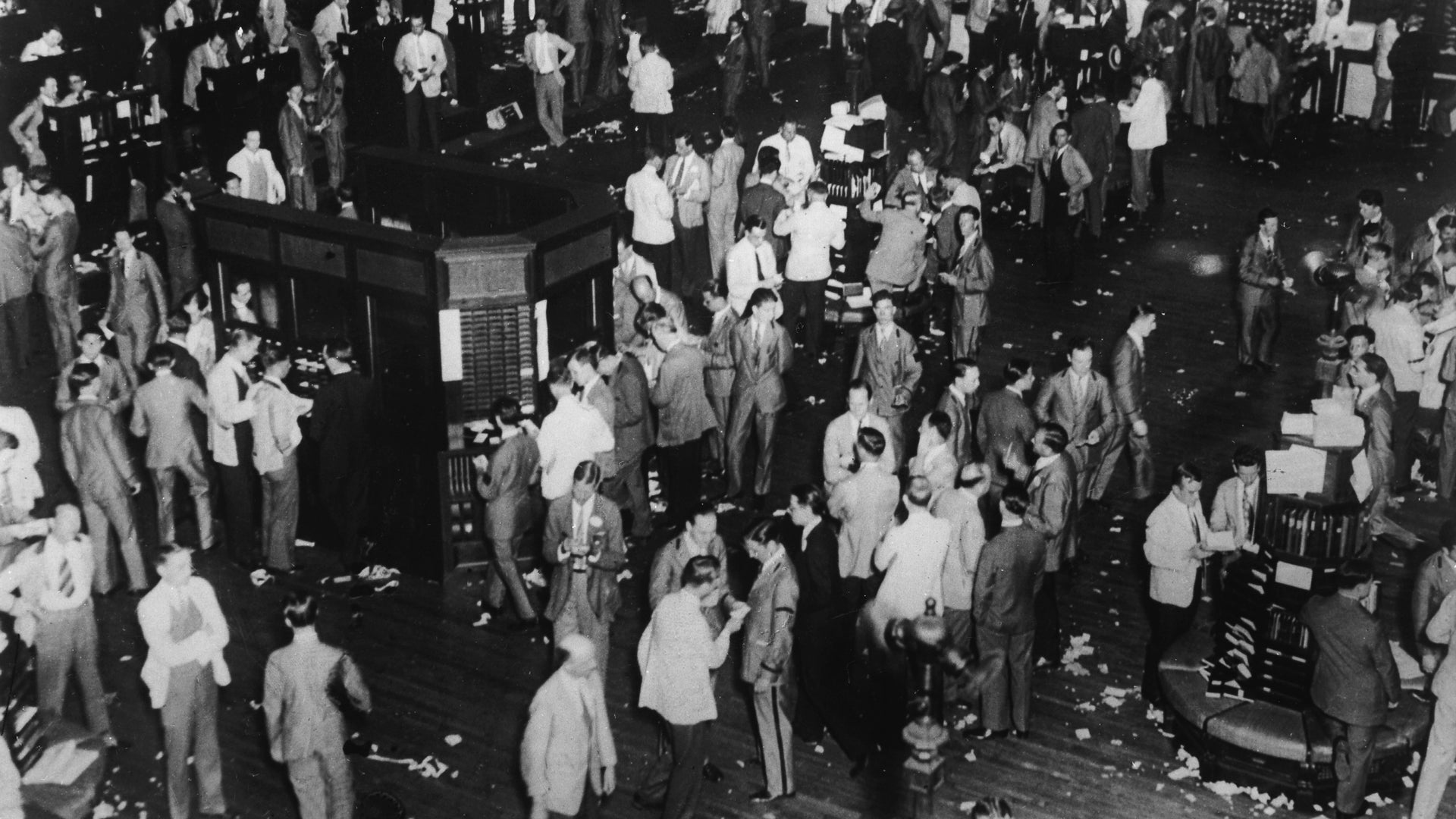

Stock market crash and Black Thursday

The beginning of the end of the turbulent era of the American economy of the 1920s was marked by “Black Thursday” on October 24, 1929. On this day, the Dow Jones index opened with a sharp drop of 11%, causing mass panic in the market. However, thanks to the efforts of large financial institutions, which managed to stabilize the situation, the scale of the fall on this day was relatively small.

But the temporary calm quickly gave way to a new wave of sell-offs. “Black Monday” and “Black Tuesday” were marked by an even more significant market collapse, as a result of which the Dow Jones index lost more than a quarter of its value.

For comparison, the peak of the stock market before the crash occurred on September 3, 1929, when the Dow Jones index reached an all-time high of 381.17 points. However, just a year later, the index fell by more than 89%, reaching a bottom of 41.22 points in July 1932.

The stocks that suffered the most from the collapse were small companies and speculative securities, many of which were completely worthless. The market’s recovery was a long process. It was not until a quarter of a century later, in November 1954, that the Dow was able to reach its 1929 level again.

What happened on Black Tuesday?

“Black Tuesday,” October 29, 1929, was the culmination of the stock market crash that marked the end of an era of economic prosperity and ushered in the Great Depression. On that day, the Dow Jones Industrial Average suffered an unprecedented 12% drop, caused by a massive panic sell-off of stocks. Fearing a further collapse in the market, millions of investors rushed to dump their securities, causing stock prices to plummet.

The Wall Street crash was the catalyst for a global economic crisis whose effects were felt for a decade. Attempts by financial elites to stabilize the situation proved futile in the face of mounting panic.

The market lost more than $30 billion in value between September and November.

The US economy on the eve of the Great Depression

In the first half of the 1920s, the U.S. economy was booming, fueled by successful exports to Europe, which was recovering from World War I. Low unemployment and the rapid spread of automobiles created new jobs and stimulated economic activity.

Prosperity led to an unprecedented excitement around the stock market. Investing in stocks became a national hobby, available not only to the wealthy.

Rising stock prices fueled even more optimism, creating a self-perpetuating cycle. Investors bought stocks in the hope of further growth, without paying much attention to the fundamentals of the companies. It became common practice to buy stocks using margin loans, which significantly increased financial risks.

However, excessive optimism and speculative investment led to overproduction in many industries. Companies, using cheap loans, actively expanded production without taking into account the real demand for their products. As a result, there was an excess supply of goods on the markets, which led to lower prices and a drop in company profits.

The situation was aggravated by growing trade barriers. In an effort to protect their producers from foreign competition, the United States and many other countries introduced high tariffs. This further reduced the volume of world trade and deepened the economic crisis.

Ultimately, the speculative boom in the stock market, overproduction, trade wars and other factors led to the stock market crash in 1929 and the beginning of the Great Depression.

Why the 1929 crash happened: a retrospective

As mentioned in the previous article, “black swans” are characterized by their unpredictability, coupled with catastrophic consequences. The stock market crash of 1929 is a striking example of this, since the preceding period was a long and steady growth of the stock market, reflected in a five-year rise in the Dow Jones index. The P/E index of industrial companies exceeded the 15 mark, which seemed quite reasonable against the backdrop of a decade of record productivity growth in the manufacturing industry.

However, serious imbalances were hidden behind the apparent prosperity. Overproduction in many industries led to a glut of steel, iron and durable goods on the market. The decline in demand forced manufacturers to sell their products at reduced prices, which negatively affected the value of shares.

At the same time, the Federal Reserve System attempted to curb speculative activity by raising the refinancing rate. According to some experts, this decision slowed economic growth and reduced liquidity in the stock market, making it more vulnerable to sharp fluctuations.

The widespread practice of margin trading played a significant role in the intensification of the crisis. During the period of market growth, investors actively used borrowed funds, which allowed them to significantly increase their profits. However, when prices fell, margin loan obligations increased sharply, forcing investors to sell assets at low prices to pay off debts.

As a result of mass margin calls caused by the market collapse in 1929, panic selling of shares began. The lack of liquidity and the inability of investors to pay off debts led to a further collapse of the market and the bankruptcy of many brokers.

The absence of a bank deposit insurance system caused a massive outflow of deposits from banks. Financial institutions that had provided significant amounts of margin loans suffered huge losses, which further worsened the situation.

The impact of the crash of 1929 on the US Economy

The following years were a period of profound economic upheaval.

- From 1929 to 1933, the US gross domestic product fell by more than a third.

- Mass bank failures wiped out the savings of millions of Americans

- Unemployment reached an unprecedented 25%.

The stock market crash of 1929 and the Great Depression that followed radically changed the lives of Americans. The optimism and consumer boom of the Roaring Twenties gave way to pessimism and economic instability.

Despite short-term attempts to stabilize the market, the panic on Wall Street quickly turned into a collapse. The Dow Jones lost almost 90% of its value in three years, and it took more than two decades to recover.

The cause of the disaster was excessive speculation in the stock market. Many investors took out loans to buy shares, counting on their rapid growth in value. However, the market collapse led to mass defaults and bankruptcies, which provoked a deep economic crisis that engulfed all areas of American life.

Did the Great Depression influence the rise of the Nazis?

The Great Depression in the United States, which shook the foundations of the world economy, had a profound impact on many countries. It had particularly severe consequences for Europe, which was closely tied to the American economy.

The allied countries of World War I, Great Britain and France, borrowed heavily from the United States to finance the war effort. The US demands for repayment of debts in the context of its own economic crisis brought the European economies to the brink of collapse.

Germany, weakened by World War I and burdened with reparations, found itself in an even more difficult situation. To pay reparations, Germany borrowed heavily from the United States, which led to even greater financial dependence. When the US demanded repayment of the debts, the German economy collapsed, causing mass unemployment and banking crises.

The economic crisis in Germany created fertile ground for radical political forces. Against the backdrop of growing public discontent, Adolf Hitler was able to use anti-Semitic and anti-communist rhetoric to attract disillusioned Germans to his side. Promising national revival and stability, he offered simple solutions to the complex problems caused by the Great Depression.

Although economic factors were not the only reason for Hitler’s rise to power, they played a decisive role in creating a political climate favorable to extremist ideas. The Great Depression pushed many Germans to search for a strong leader who could lead the country out of the crisis, and Hitler was able to take advantage of this mood.

Did the Great Depression end with World War II?

The United States’ entry into World War II in 1941 significantly changed the trajectory of the Great Depression. Statistics on employment and GDP show a sharp decline in unemployment and an increase in economic activity in the early 1940s. However, these figures mask more complex processes.

The mobilization of millions of Americans for military service led to a reduction in the private sector labor force. Although the total number of people employed increased, the real unemployment rate in the non-military sector of the economy remained high.

War spending, accompanied by the introduction of government price controls and restrictions on consumption, led to a decline in the standard of living of the population. Significant tax increases were necessary to finance the war effort. Private investment fell by almost a third, and total private sector output fell by almost half.

The common view that the war was the main factor in the United States’ recovery from the Great Depression oversimplifies the situation. While the conflict did stimulate economic growth, its contribution to economic recovery was mixed. The war opened up new opportunities for industrial development and international trade, but it also caused destruction and loss of life.

A more accurate statement would be that World War II accelerated the United States’ recovery from the Great Depression, but it wasn’t the sole cause of this process. After the war, private investment began to recover rapidly, indicating significant pent-up demand.

Why did the Hoover administration fail to cope with the crisis?

Protectionism. In the context of the growing economic crisis, Republican President Herbert Hoover was forced to resort to protectionist measures aimed at protecting American industry. In 1930, the Smoot-Hawley Tariff Act was passed, despite harsh criticism from economists. This law imposed high tariffs on imported products, significantly reducing the volume of international trade.

Initially, the law was intended to protect agriculture, but its effect was extended to a wide range of goods. In response to the introduction of high tariffs, many countries took similar measures, which led to a sharp reduction in world trade and a deepening global economic crisis.

In an effort to maintain employment and income levels, the Hoover administration urged businesses to maintain high wages and prices, even despite the decline in demand. However, these measures, aimed at artificially maintaining economic equilibrium, proved ineffective. The U.S. economy continued to stagnate, and unemployment grew.

Thus, the protectionist policy pursued by the Hoover administration not only failed to help overcome the crisis, but also worsened it. Artificially maintaining high prices and wages led to a decrease in the competitiveness of American industry and a reduction in production volumes. As a result, the U.S. economy deteriorated from recession to depression, the exit from which became possible only after a radical revision of economic policy.

Mistakes of the Federal Reserve System. The Federal Reserve System, created in 1913, demonstrated a relatively passive policy during its first years of existence. However, the situation changed dramatically after overcoming the economic downturn of 1920-1921. The Fed began to actively expand the money supply, which led to a significant increase in various financial indicators.

Between 1921 and 1928, the total money supply increased by 61.8%, which contributed to the growth of bank deposits, savings and loan stocks, and net reserves of life insurance policies. Such a significant increase in the money supply was due to the reduction in the required reserves of commercial banks, carried out by the Fed in 1917.

The aggressive monetary policy of the Federal Reserve System, expressed in the increase of the money supply and the maintenance of low interest rates, created conditions for the formation of speculative bubbles in the stock and real estate markets. This process, according to Ben Bernanke, the former chairman of the Federal Reserve System, led to a significant increase in the money supply in the economy, which exceeded real needs.

Before the creation of the Federal Reserve System, banking crises were usually resolved by private financial institutions. Thus, during the panic of 1907, J.P. Morgan was able to mobilize financial resources to support the banking system. However, by 1929, the US financial system had become so complex and interconnected that even the joint efforts of the largest banks were insufficient to prevent a collapse.

That is why, after the crash of 1929, it became obvious that a central bank with sufficient resources and powers was needed to maintain the stability of the financial system. The Federal Reserve System, created precisely to fulfill this role, was unable to prevent the Great Depression, but its experience showed the need for active government intervention in the economy during periods of crisis.

Hoover’s role. Hoover, despite the widespread opinion about his passivity in the conditions of the economic crisis, took a number of significant measures to stabilize the situation. In the period from 1930 to 1932, large-scale government programs were implemented aimed at stimulating the economy and supporting the population.

One of the key areas of Hoover’s policy was a significant increase in government spending. Budget appropriations increased by 42%, which made it possible to finance large-scale infrastructure projects and create new jobs. One of the most significant instruments of government support was the Reconstruction Finance Corporation (RFC), designed to provide loans to businesses and banks.

New taxes were introduced to cover increased government spending. In addition, a law banning immigration was passed in order to protect the domestic labor market.

The key element of Hoover’s economic policy was the idea of maintaining high wages and prices. The president feared that lowering wages would lead to a further decline in demand and aggravate the economic crisis. However, attempts to artificially maintain high prices and wages encountered serious difficulties.

On the one hand, the population, which had suffered from the economic crisis, didn’t have sufficient purchasing power to maintain a high level of consumption. On the other hand, foreign countries, which were facing their own economic problems, were not ready to buy American goods at inflated prices. As a result, the protectionist policy of the United States led to a reduction in international trade and further isolated the American economy.

How the Great Depression was coped: Roosevelt’s New Deal

Upon assuming office in 1933, Democrat Franklin Roosevelt announced large-scale reforms. The New Deal program, developed by him to overcome the Great Depression, was a set of unprecedented measures of state regulation of the economy. Based on the principles of Keynesian theory, Roosevelt set the goal of stimulating economic growth through active state intervention.

The main principle of the New Deal was active state intervention in the economy. The federal government assumed responsibility for creating jobs, regulating industry, and providing social protection for the population. This approach significantly expanded the role of the state in American society.

The key elements of the New Deal were the abolition of the gold standard, the prohibition of monopolistic activity, the creation of large-scale public works programs, and support for agriculture. Federal taxes were significantly increased to finance these programs.

Legislation passed as part of the New Deal covered a wide range of economic issues. Among the most significant acts were the

- Agricultural Adjustment Act (AAA): aimed to stabilize agricultural markets by limiting production and raising prices for agricultural products.

- National Recovery Act (NRA): established industry codes regulating prices, wages, and working conditions, and gave workers the right to collective bargaining.

- Federal Emergency Relief Act (FERA): provided federal grants to states to fund social assistance programs such as soup kitchens and public works.

- Federal Deposit Insurance Corporation (FDIC) Act: increased confidence in the banking system by guaranteeing the return of deposits in the event of bank failure.

In addition, the New Deal created the Securities and Exchange Commission (SEC) to regulate the stock market and protect investors.

Despite some success in stabilizing the financial system and restoring public confidence, the New Deal failed to completely lift the United States out of the Great Depression. Economists disagree on the reasons for this. Some economists believe that government spending was insufficient. Others argue that excessive government regulation slowed economic recovery.

Nevertheless, the institutions created by Roosevelt’s reforms largely made the American market what we know it today.

Do you want to know

How to make money from the news

Register for free and get:

- Expert consultation;

- Access to the training course;

- Opportunity to participate in webinars