- Investment ideas

Semiconductor sector: importance for the market

Do you want to know how to make money from this?

Register for free and get expert advice, access to a training course and webinars.

This week is filled with news about technology companies. For example, it became known that the demand for personal computers had recovered again, and the White House administration itself decided to invest in Samsung. In fact, these events indicate deeper processes in the market, namely the priority of the semiconductor sector for financial players. Why did the market fall in love with semiconductors?

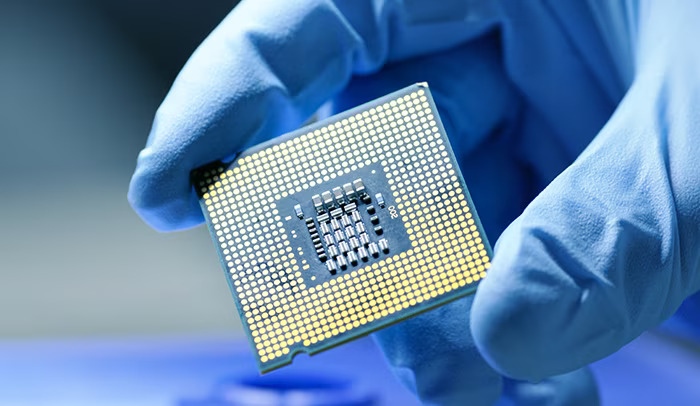

Semiconductor materials have unique electrical conductivity, acting as conductors only under certain conditions. This property determines their key role in modern electronics. Semiconductors have applications in countless devices, from smartphones and laptops to cars and medical equipment. Critical semiconductor components include microprocessors, memory modules, integrated circuits, and other components.

The key to modern technology

The importance of semiconductors stems from their ability to process and transmit information, which has stimulated global innovation and turned them into a key sector of the global economy. Companies involved in the development, production and marketing of semiconductor products are among the largest players on the world’s stock exchanges. Semiconductors are an integral part of the functioning of modern electronics, serving as a catalyst for the introduction of new technologies such as artificial intelligence.

Recently, there has been an unprecedented shortage of semiconductors caused by disruptions in supply chains. The COVID-19 pandemic, natural disasters, trade disputes and shipping issues have reduced production capacity. These shortages have impacted many industries, including automotive, consumer electronics and healthcare, causing product delays, lower revenues and higher prices.

Steps are being taken at the corporate and national level to address these issues by increasing production capacity, diversifying supply chains, and investing in new technologies. However, the effects of the shortage will likely continue to be felt for some time until these measures have their full effect.

Increased demand

The semiconductor industry is experiencing a chip shortage that has been exacerbated by the COVID-19 pandemic. The pandemic has disrupted supply chains and led to plant closures due to lockdowns and other public health measures in place around the world. While PC sales have declined in the past, overall demand for semiconductors of all types—from basic microcontrollers and memory chips to complex, high-performance processors—has grown beyond manufacturers’ capabilities. Despite current difficulties, the industry remains highly profitable.

Before COVID-19, the industry was already experiencing supply constraints due to rising demand driven by new technologies. Moreover, the pandemic has further changed global semiconductor demand as people shift to remote work and online learning.

In addition to increased demand, the semiconductor industry is also facing disruptions caused by geopolitical risks and trade tensions. For example, in recent years the US government has imposed export restrictions on Chinese semiconductor companies, citing concerns about intellectual property theft and national security risks.

Industry recovery

In the second half of 2023, the semiconductor industry showed a recovery. This was largely due to the influence of NVIDIA Corp. – a leader in the growing market for GPUs for artificial intelligence applications. NVIDIA was the largest contributor to SMH’s earnings in the second quarter of 2023, ahead of Broadcom Inc. is a diversified chip manufacturer with a strong position in the wireless communications, data center and industrial solutions markets.

The semiconductor industry’s growth in 2024 is expected to be driven by the following factors:

- Demand for semiconductors will continue due to the development of new technologies such as 5G, cloud computing and artificial intelligence. These technologies will require more advanced and efficient chips.

- Reduced trade tensions between the US and China could lead to improved supply chains and greater market access for some semiconductor companies.

- Providing grants and other incentives from the U.S. government to support domestic chip production.

Do you want to know

How to make money from the news

Register for free and get:

- Expert consultation;

- Access to the training course;

- Opportunity to participate in webinars