- Trading basics

How to choose trading assets: a brief guide

Do you want to know how to make money from this?

Register for free and get expert advice, access to a training course and webinars.

Every new trader is faced with one of the key questions in trading: what assets are worth investing in? In fact, there is no one-size-fits-all approach to choosing the best stocks to invest in. It all depends on several factors: the outcome you are trying to achieve, your risk tolerance, and the time and capital you have available. Therefore, you need to understand the important characteristics of the major asset classes and select them based on your own individual circumstances.

ParadTrade sheds light on the features, advantages and disadvantages of 5 major assets.

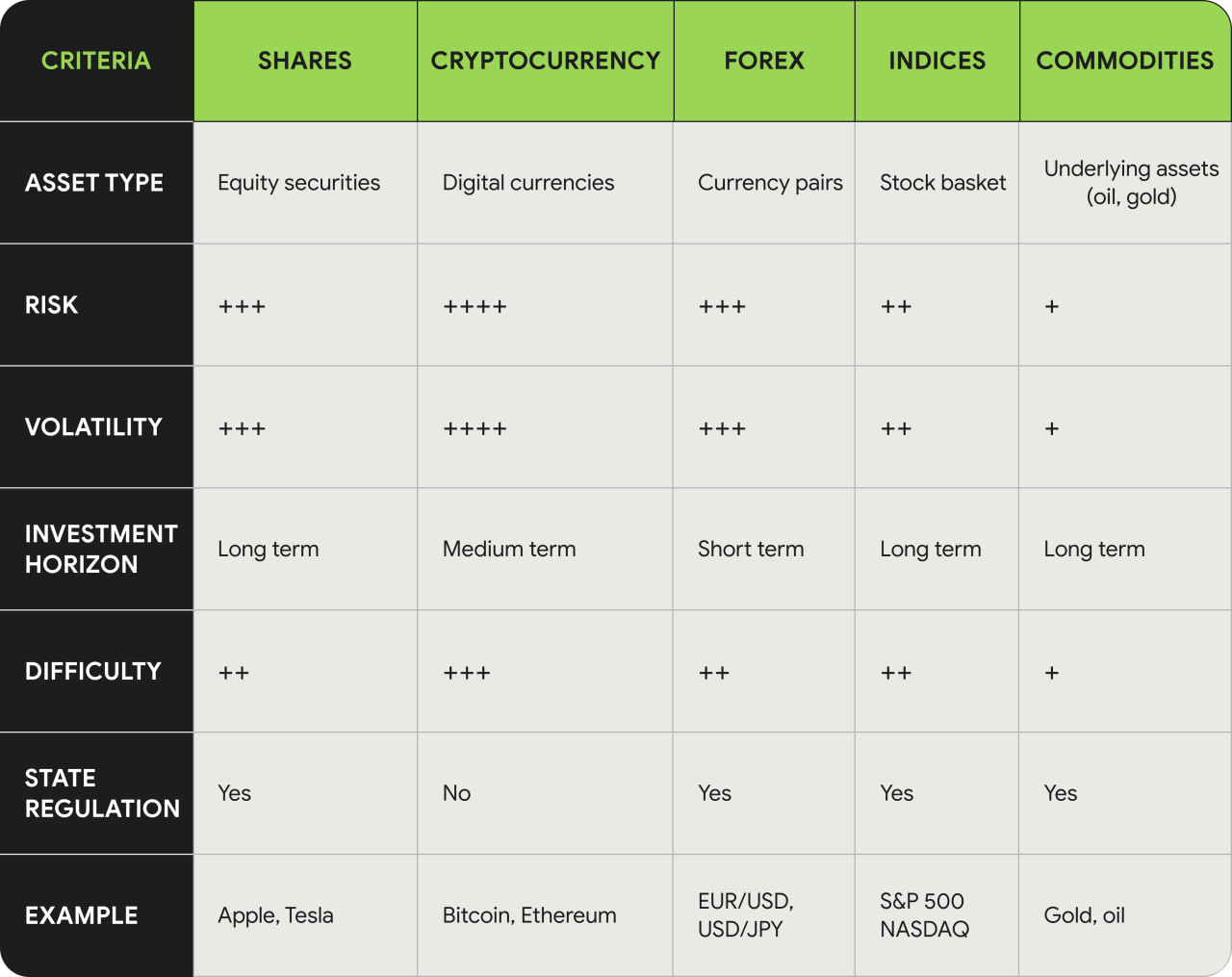

Brief comparison of 5 assets.

Shares: a choice for long-term investment

A share represents an interest in a company that is publicly traded on a stock exchange. Shares are one of the key tools in investment strategies. The value of a company is determined by the number of shares outstanding multiplied by the current price of each share.

Shares are traded on stock exchanges such as the New York Stock Exchange (NYSE) and NASDAQ (USA), London Stock Exchange (LSE) (UK) and Euronext (Europe).

Owning shares gives you the right to part of the company’s profits (dividends), as well as participation in the management of the company – for example, the right to vote at a meeting of shareholders.

Another feature of the asset that may be both a plus and a minus for you is that stocks are usually considered as a tool for long-term investment. The choice of stock trading strategy depends on the investor’s goals, risk appetite and investment time horizon. At the same time, shares are a rather volatile asset, so proper handling of them requires knowledge of the stock market and regular monitoring of news.

Cryptocurrency: decentralized and volatile

Cryptocurrency is a digital asset that uses cryptographic techniques to provide security and verify transactions. The decentralized structure of the system is a key characteristic of cryptocurrencies. This makes them theoretically immune to manipulation by governments, and also eliminates the possibility of a single point of failure that could lead to global financial crises like the one caused by the collapse of large investment banks in the United States in 2008. The purchase and sale of cryptocurrencies is carried out on specialized exchanges – in particular, on Binance.

Another attractive feature of cryptocurrencies is the use of cryptographic techniques to secure the digital or virtual currency. This makes it virtually impossible for the funds to be counterfeited or reused.

However, this asset class is relatively new and is characterized by increased speculativeness and volatility, which requires the trader to be more risk-tolerant. Cryptocurrencies are not tied to any tangible assets, which makes them more susceptible to market sentiment and news events.

Commodities sector: assets with a century-old history

Commodities are tangible assets that are used for trading in financial markets. These include categories such as gold, oil, wheat, soybeans, etc. Pricing of goods is determined by the balance of supply and demand, and is also influenced by various factors such as weather conditions, geopolitical events and the general state of the economy.

Unlike cryptocurrencies, the history of commodity trading dates back centuries. They are traditionally positioned as a more conservative and stable investment instrument, and therefore are relatively safe for novice traders. Commodity futures contracts have corresponding physical equivalents, and price dynamics directly depend on the relationship between supply and demand.

However, the return on investment in goods is determined not by profit, but by the dynamics of supply and demand, so it is lower for these assets than for riskier ones.

Forex: a dynamic but risky market

Forex is a decentralized over-the-counter market where currencies of different countries are traded and traders speculate on fluctuations in exchange rates, making transactions to buy and sell currency pairs. It is the most liquid financial market in the world, with daily trading volume exceeding US$8 trillion.

Traders make profits on Forex by playing on the difference in exchange rates. Strategies may include buying a currency when it declines and then selling it when the rate rises, or, conversely, selling a currency at its peak and buying it back when it declines. Foreign exchange markets are sensitive to economic news, such as the release of macroeconomic indicators, central bank interest rate decisions, and geopolitical events.

Currency as an asset class attracts retail traders due to its low barriers to entry. To start trading, it is enough to have a computer with Internet access and a small starting capital.

However, it is important to understand that Forex is a high-risk market. Volatility in foreign exchange rates can lead to significant losses, so traders need to carefully study the market, use effective trading strategies and manage risks wisely.

Indices: making asset selection easier

The goal of an index fund is to benefit from the broader market by tracking a selected index. The most popular index to track is the S&P 500, with a historical annual return of 10%. Exchange traded funds (ETFs) are the preferred vehicle for index investing. This is because ETFs are passively managed and therefore have low costs—an ideal environment for an index fund.

The main advantage of index investing is that it simplifies the process of selecting assets compared to building a portfolio yourself. Index funds contain hundreds of stocks that would be difficult to collect on an individual level. However, at the same time, this is also the disadvantage of this tool: it is not possible to add or remove any assets from the index fund that you consider irrelevant for your purposes.

Do you want to know

How to make money from the news

Register for free and get:

- Expert consultation;

- Access to the training course;

- Opportunity to participate in webinars